Housing inventory is at an all-time lowcost. You will find 39% fewer houses available today than at this time this past year, and buyer demand continues to set records.

Housing inventory is at an all-time lowcost. You will find 39% fewer houses available today than at this time this past year, and buyer demand continues to set records.

Whenever there’s a shortage in supply of an item that is in high demand, the cost of the item increases. That is exactly what’s going on in the real estate market at this time. CoreLogic’s latest Home Price Index reports that values have risen by 5.5% over the last year.

This is great news if you’re planning to sell your house; on the other hand, as either a first-time or repeat buyer, then this might instead look like upsetting news. Nevertheless, buyers should understand that the cost of a house is not quite as vital as the price. Let’s break it down.

There are lots of factors that influence the expense of a home. The two major ones are the cost of this home and the interest at which a buyer can borrow the funds necessary to buy the home.

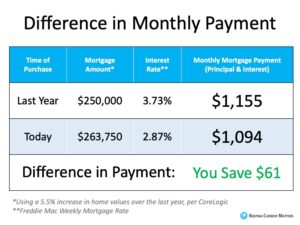

Last week, Freddie Mac announced that the typical rate of interest to get a 30-year fixed-rate mortgage has been 2.87%. At this time this past year, the speed was 3.73 percent. Let’s use an illustration to see how that gap impacts the true cost of a house.

Assume you bought a house last year and took out a $250,000 mortgage. As mentioned previously, home values have increased by 5.5% during the last year. To purchase that same house this year, you would need to take a mortgage at $263,750.

The difference in monthly payments based on today’s low mortgage rates.

That’s a savings of $61 monthly, which adds up to $732 annually and $21,960 over the life of the loan.

It’s a great time to sell your home cause of low inventory and buyers ready to buy and a great time to buy a home cause mortgage rates are at historic lows.

Contact our office today to get you started on the path to your dream home!