If you’ve been considering selling your home, now is a great time to put your high-demand home on the market. There are numerous buyers looking to purchase a home in your neighborhood, yet listings are scarce- your home’s value may benefit! We can help you take advantage of this buyer demand by selling your home. When your ready to list, please call us for a free market analysis on your home. Interest rates are on the rise and buyers are ready to buy now.

If you’ve been considering selling your home, now is a great time to put your high-demand home on the market. There are numerous buyers looking to purchase a home in your neighborhood, yet listings are scarce- your home’s value may benefit! We can help you take advantage of this buyer demand by selling your home. When your ready to list, please call us for a free market analysis on your home. Interest rates are on the rise and buyers are ready to buy now.

Contingent vs. Pending

If your real estate broker places your home in the multiple listing service, then it’s going to have an”Active” status. This implies that it is readily available for showings. Nonetheless, this is merely the beginning with several things to do prior to the status changes to”Closed.”

If your real estate broker places your home in the multiple listing service, then it’s going to have an”Active” status. This implies that it is readily available for showings. Nonetheless, this is merely the beginning with several things to do prior to the status changes to”Closed.”

You will find different statuses from the MLS listings such as”Pending,””Contingent,””Coming Soon” and”Expired.” What do they mean and how can they impact your house sale? Among the most vexing things for sellers and buyers to know is what located methods vs. impending.

Contingent vs. Pending?

Two major statuses from the MLS are”Contingent” and”Pending.” They reveal that you’ve got a buyer that has signed a contract with you. It usually means that both parties have approved the provisions inside the contract, currently legally binding. Regardless of this, there may nevertheless be space to negotiate the terms of this sale.

Contingent Meaning

The contingent tag in a list indicates that the vendor has accepted the offer nevertheless, certain things will need to occur before things can proceed. It demonstrates that the contract was agreed upon, but some work still has to be performed before closure.

The contingent status generally allows the house to be revealed to other potential buyers, allowing backup supplies to be created. This protects the vendor should something goes wrong, providing them the choice to proceed to a different purchaser immediately, if needed.

Not all revenue will have contingencies together, but most will. Frequent property contingencies comprise the following:

Inspection Contingencies

The most frequent contingency is your home inspection contingency. Approximately 60 percent of earnings have this particular contingency, and it makes sure that the buyer is not purchasing a property with severe flaws.

In case the home review finds acute troubles, or the vendor does not agree to fix or provide credits, then the purchaser can walk off. The home inspection may result in some flaws in the procedure, also, for approximately 10 percent of cases.

Financing or Mortgage Contingencies

Nearly all homebuyers use a loan to finance their purchases. The financing contingency makes certain the buyer can procure the quantity of fund they want for your buy. This sort of contingency is located in approximately half of their purchase contracts. Lending issues delay closing in about a third of all property transactions.

Buyers will need to keep tabs on the mortgage contingency to be certain that it doesn’t lapse. Doing this could mean that the forfeiture of the real money deposit.

Appraisal Contingencies

Lenders are not likely to give cash for a house that the buyer’s deal has overvalued. To guarantee they aren’t committing over the house is actually worth, they’ll use a property appraiser to detect the fair market value.

If the appraisal comes in lower than the sum the purchaser has provided, it might halt the buy in its tracks–issues such as this accounts for almost 20 percent of contracts that are delayed.

Title Contingencies

A name business is utilized to be certain that the residence is not maintained by somebody else. If the house has a clear name, there will not be any constraints or liens on the house, and there should not be any probable disputes over possession in the future. Title contingencies could be accountable for approximately 10 percent of delayed earnings.

Home Sale Contingencies

Occasionally a buyer should be certain they’ve sold their existing residence before they can buy another. The house sale contingency is not that common but can slow down the process.

Pending Meaning

When a residence is listed as pending, it usually means there are not any contingencies to handle or that they’ve already been handled. This proves that the home has gone through the contingent phase, and the purchaser is expected to close on your house.

What Other MLS Statuses Are You Really?

There are dozens and dozens of different MLSs in performance throughout the nation, which means that you may view some slightly different conditions used. By way of instance,”Active Contingent” and”Lively Under Contract” may be used rather than”Contingent.”

Other Frequent Statuses You Might Discover Can Contain:

— Coming Shortly: whenever there’s a contract or record agreement with a broker or listing broker, but things are not quite ready yet. Maybe the vendor requires a while to fix up the house before it’s prepared for the marketplace or it’s new construction. Occasionally these”Coming Soon” statuses are restricted from the MLS to some couple weeks.

— Withdrawn: This sometimes happens whether the vendor has made a decision to pause showings and offers around the house.

— Canceled: The list contract for the home was canceled in writing.

— Expired: Listings contracts just run for some quantity of time, and if they die, the residence will no longer be on the marketplace.

— Closed: The house was sold.

Also as these statuses, realtors can leave other opinions to describe the circumstance.

Status updates will need to be made quite fast over the MLS. Many MLSs will have principles that realtors must follow to guarantee the statuses are as precise as they may be.

The Differences Between Allergic and Contingent

The significance of contingent places more possible roadblocks in the manner of a completed purchase. On the flip side, a pending status signifies the selling procedure is nearly finished, and things are just about to close.

Having a booming status, the vendor remains available to accepting offers on their home. This provides the vendor a backup, if their very first buyer back out of this deal for any reason.

Even though it’s rather uncommon for earnings to drop through, possibly happening less than 10 percent of their time, it’s very good to have a backup. Because of this, it aids the seller when their broker is lining up options, should their present buyer straight out. And when their purchaser does out, the vendor could discover that they have got another buyer prepared to go who comes with a much better deal.

Closing Cost For Land

Closing costs refer to a range of fees utilized to finalize a property transaction. These are additional costs paid on top of the purchase price, and for most buyers, wind up adding tens of thousands –or even tens of thousands–of dollars on the first spend. Because of this, it is crucial to factor in closing costs when deciding if a piece of land is based on what you can afford.

There are an assortment of different cost factors included in property closing costs. They may change based on how you fund your property buy and that you use to finalize the price, but these are the costs you will need to think about as you figure out how much a parcel of land may run you.

• Escrow fees — In addition to paying escrow itself, additionally, there are escrow fees, such as fees to hold funds and ease the transaction.

• Bank fees — If you take a loan out for your property, expect to cover origination charges, processing fees, credit report fees, and application fees, among other potential relevant costs.

• Transfer taxes — You will find taxation involved in transferring land from 1 owner to another (typically a set percentage of the transfer cost ), with the specific speed depending on what state you are purchasing.

• Recording fees — These are fees for drafting and documenting the property sale in public documents.

• Agent and attorney fees — Commission charges for both the buyer and seller’s broker, and any relevant attorney fees.

• Other third party charges — Plan having additional closing costs for paying appraisers, surveyors, inspectors, and anyone else whose services that you use to shut your buy.

In many land sales, it is the buyer’s duty to pay closing costs. That said, a few buyers can arrange to divide closing costs with the seller–or perhaps have the seller pay for all of them. The better price you are offering from the start, the better chance you have of alleviating some of the final cost burden, since a seller might be prepared to cover some or all of the costs if it means a shorter closing period or a cash buy.

Closing costs for land is negotiable just like everything else in real estate. Who pays, how much they pay, and if things become paid out are all things that you may have the ability to negotiate on your favor, although there are never any guarantees.

Texas Realtors- How Improvements Affect Value

A beautiful mural for a child’s bedroom. A handmade gazebo for early summer nights. An elaborate and well-maintained garden. Buyers and sellers may highly value these additions, but appraisers will not.

A beautiful mural for a child’s bedroom. A handmade gazebo for early summer nights. An elaborate and well-maintained garden. Buyers and sellers may highly value these additions, but appraisers will not.

These cosmetic features do not raise a home’s appraised value, says David Morgan, a Dallas-Fort Worth area broker and Certified General Appraiser with 35 years of experience in residential and commercial real estate.

“As an appraiser, you’d look at homes that sold with a simple gazebo and ones that sold without, and chances are there’s not any difference in the sales price,” he says.

Site improvements, such as an accessory dwelling unit or an outdoor living area with kitchen, can add value. Clients should not expect a dollar-for-dollar return on their investment, Morgan warns.

“I’ve seen people put in a $50,000 outdoor living area in a $200,000 neighborhood and expect to get $50,000 more when they go to sell it, and it’s not there. It’s an over-improvement. You paid more for it than the market will recognize in the value increase,” he says.

Swimming pools are the classic example of an over-improvement, Morgan says. “You put in a $60,000 pool in a $300,000 neighborhood and it increases the value maybe $20,000 or $25,000.”

The market value of these improvements matters because deals can be at risk if the property is appraised below the asking price. Depending on the contract, the buyer can back out of the deal or negotiate a different price. Buyers can also find another lender and appraiser, which Morgan says is not uncommon.

That said, not all site improvements or cosmetic updates add value, but most add marketability, Morgan says. “That means it makes it easier to sell because buyers like it, which usually results in less time on the market. However, it’s wiser to remodel or update kitchens and bathrooms than build a gazebo or a fancy mural. That’s where real value is added,” he says.

https://www.texasrealestate.com/members/posts/how-improvements-affect-value/

The Cost Of The Home Is More Important Than The Price

Housing inventory is at an all-time lowcost. You will find 39% fewer houses available today than at this time this past year, and buyer demand continues to set records.

Housing inventory is at an all-time lowcost. You will find 39% fewer houses available today than at this time this past year, and buyer demand continues to set records.

Whenever there’s a shortage in supply of an item that is in high demand, the cost of the item increases. That is exactly what’s going on in the real estate market at this time. CoreLogic’s latest Home Price Index reports that values have risen by 5.5% over the last year.

This is great news if you’re planning to sell your house; on the other hand, as either a first-time or repeat buyer, then this might instead look like upsetting news. Nevertheless, buyers should understand that the cost of a house is not quite as vital as the price. Let’s break it down.

There are lots of factors that influence the expense of a home. The two major ones are the cost of this home and the interest at which a buyer can borrow the funds necessary to buy the home.

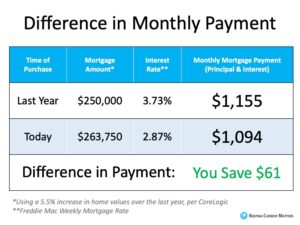

Last week, Freddie Mac announced that the typical rate of interest to get a 30-year fixed-rate mortgage has been 2.87%. At this time this past year, the speed was 3.73 percent. Let’s use an illustration to see how that gap impacts the true cost of a house.

Assume you bought a house last year and took out a $250,000 mortgage. As mentioned previously, home values have increased by 5.5% during the last year. To purchase that same house this year, you would need to take a mortgage at $263,750.

The difference in monthly payments based on today’s low mortgage rates.

That’s a savings of $61 monthly, which adds up to $732 annually and $21,960 over the life of the loan.

It’s a great time to sell your home cause of low inventory and buyers ready to buy and a great time to buy a home cause mortgage rates are at historic lows.

Contact our office today to get you started on the path to your dream home!

Deciding on The Ideal Home Size for Your Family

Making the decision to purchase a new home is a significant decision for anyone. Once you’ve settled on the concept that you do wish to get a house, there are many more choices you are going to have to face; among the most important is the ideal size of a home to best fit your loved ones and lifestyle.

Realize That Bigger Is Not Always Better

You may initially begin your house search thinking that size does not really matter. So long as it seems big enough to reside in, you do not care how large it actually ends up being. The truth is that bigger is not always better. A large home requires more money–and time to preserve. Unless you’re using the distance, you might just end up wasting your money on keeping up a big house for no reason.

Know Your Own Maintenance Budget

A crucial component of your home purchase choice will be to ascertain what your budget will be for home maintenance. A larger home requires more time and money to look after, especially if you’re looking at houses with substantial front and backyards. In terms of the interior, there are cleaning, energy and repair costs for cooling and heating. Discuss your budget with your partner and your real estate agent to decide the square footage you can realistically handle.

Identify the Number of Rooms You’ll Need

If you really don’t understand what amount of space is ideal for your family, then you want to start simple. This implies counting the number of rooms which you’ll need. Consider your main rooms such as your kitchen and living space, and then proceed to counting the amount of bedrooms and baths that you need. This gives you an excellent starting point to identifying just how much space your family members will require. Keep in mind if you intend on enlarging your family, if you often have guests visit and if you might have to get a relative, like an aging parent, live together with you later on.

Once you get an notion of the size range that will fulfill your requirements, it’s time to take a few excursions. Look for homes which are in the appropriate size range which you just determined. This isn’t so much about assessing potential purchases as it is all about determining if that size range will fit what you are considering. Home tours will give you a clearer idea of what you would like the square footage of your home to be and the way you want those square feet distributed throughout the bedrooms, common areas and outside.

Determining the right size house for your loved ones may be challenging at first. Start by breaking down your budget versus what you think you’ll want and give us a call so we can begin looking at sample homes and go from there.